Examples not to follow: Ontario ONSAT and biofuels production

Two examples in Ontario of why the Canadian economy continues to be at risk from the aggressive threats of tariffs from the USA.

Two examples in Ontario of why the Canadian economy continues to be at risk from the aggressive threats of tariffs from the USA.

The biggest white lies we tell each other are when excuses do not match the real reasons we are doing something. Trump has expanded this out to American policy, the lies are bigger but the concept is the same.

Energy and processing power analysts are very taken with the Jevons paradox. The concept is that as energy or processing power become more efficient, demand expands to use up that increased efficiency and everyone wins. It has been applied in great haste by investors and firms in the AI space. Especially since much more efficient open source solutions have been made available commercially (such as DeepSeek).

Tariffs on Canadian oil imports and exports can change price calculation in the USA, making the market more susceptible to local conditions. Moves to increase the price of oil in the USA will bring more domestic production online and will speed-up ongoing transition of refineries and pipelines to use Permian/fracked oil.

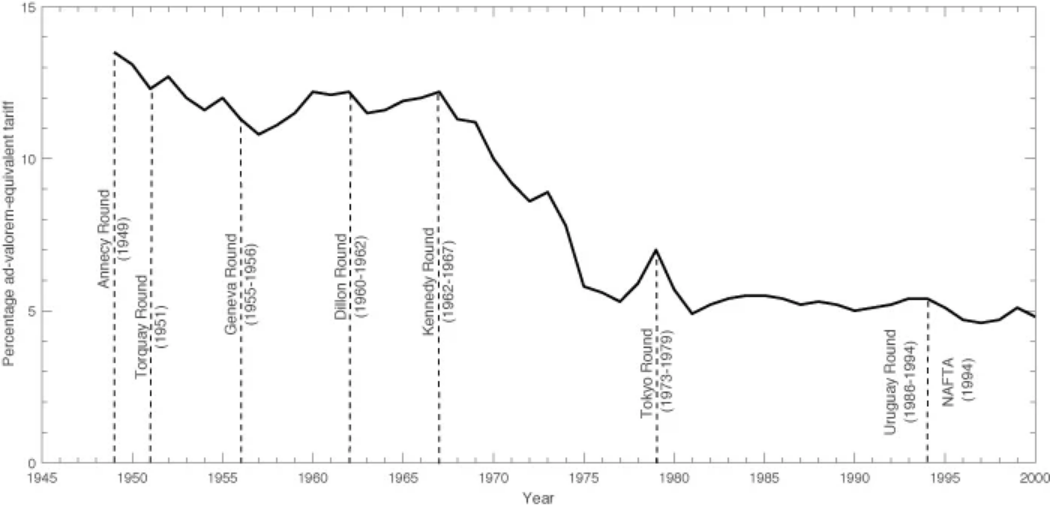

A major issue for Canada is that investment flows from the USA. It is 80 years since the end of the 1930s tariff regimes that lead to expanding dependence on trade with the USA. Capital investment is from US-based finance.

What can we say about 2024 and the times we live in? We live through so little that can qualify as reassuring or hopeful.

Ever wonder what the discussion about tariffs is actually about? There are a lot of explanations on the internet and in the news about what a tariff is.

The discussion of prices, inflation, and taxes are informed by ideology. The ideologies driving our understanding of economics, how we talk about money, and who we expect to pay for certain things determines both our understanding of what is going on in the world and how we should respond to it.

The word 'resiliency' is one of the more overused words in the wake of the pandemic. Things that were disrupted because of lack of proper investment include our supply chains that move goods around the world. It is not just global pandemics that cause major crises along these supply chains.

Supply chains are still a bit of a mess since the pandemic. The ongoing geopolitical crises, climate change effects, and poor private sector management of large projects are putting intense strain on the transport industry and the costs cannot be understated.