Tariffs, money, and dollars

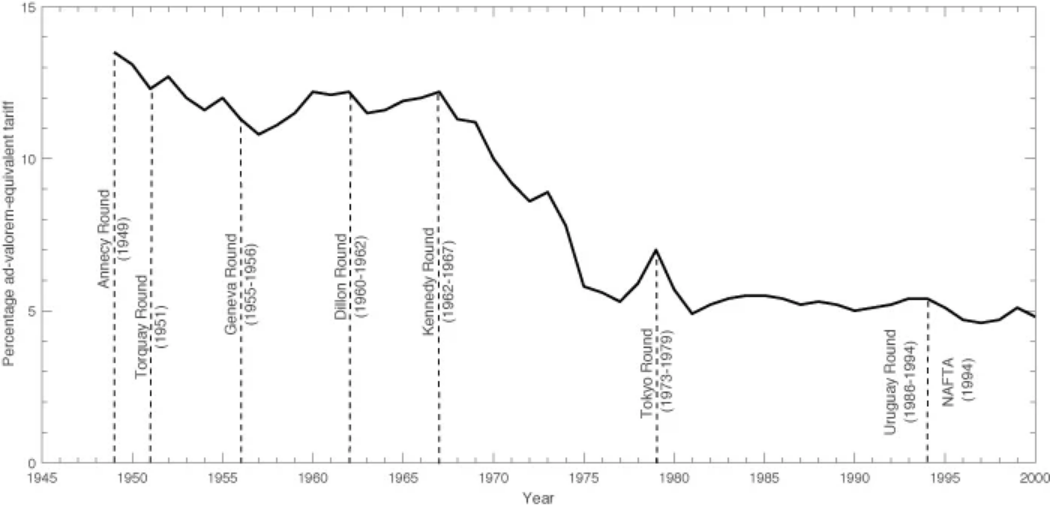

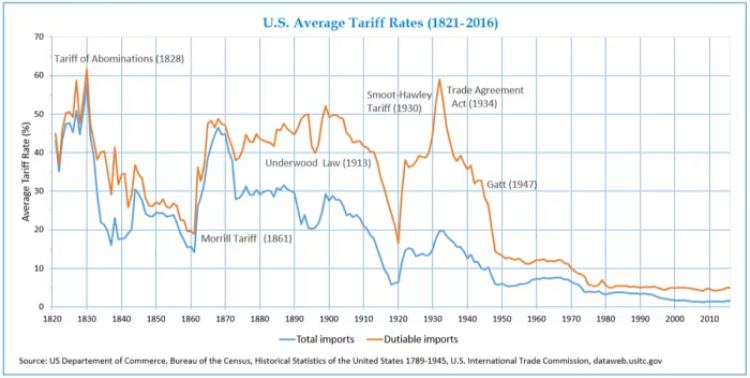

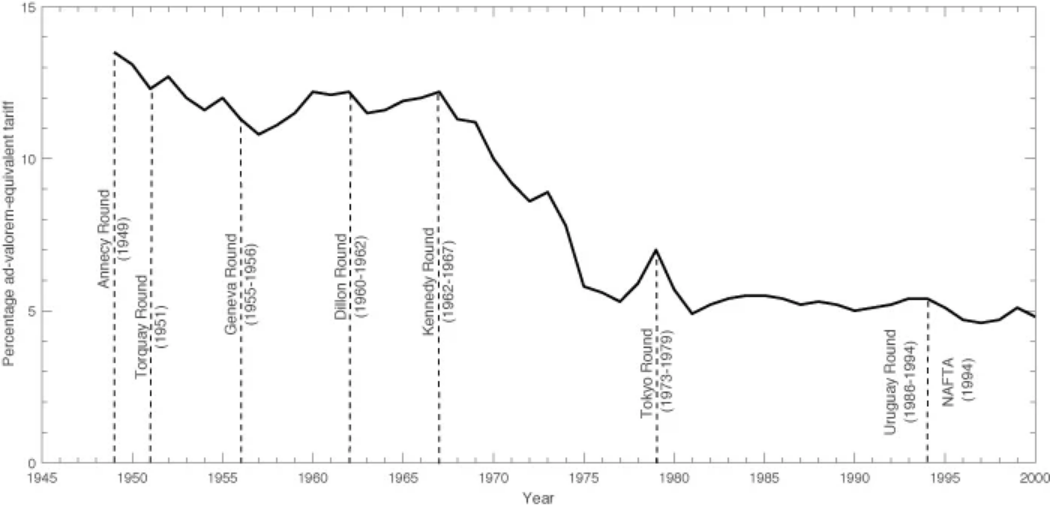

A major issue for Canada is that investment flows from the USA. It is 80 years since the end of the 1930s tariff regimes that lead to expanding dependence on trade with the USA. Capital investment is from US-based finance.

Dollars falling

Canada's dollar is cheap compared to the USA and is falling after the tariff announcements.

What does that mean and should we care?

According to classical theory: "exchange rates are determined by the equalization of profit rates across international regulating capitals, for socially determined national real wages." (Shaikh 1999).

In other words, the price of the Canadian dollar falls when there is higher profits expected to be made on new investments outside of Canada because subsidies are higher, productivity is higher, and/or wage rates are lower elsewhere.

- "subsidies" here mean wealth transfer from workers to companies through the state.

- productivity here is technology adoption for replacing workers with machines.

- wages here mean real comparable total compensation and tax bills for employees producing the same product sold by the company making the highest profit rate.

The issue for Canada is that "elsewhere" is the USA. Because of 80 years (since the end of the 1930s tariff regime) of expanding dependence on trade with the USA, capital investment is from US-based finance.

So, all that you need for the shift in dollar values in Canada is the relative shift in expected profitability between the USA and Canada.

The threat of changes to that trade regime by the imperialist end of that regime, as Trump has done, is enough to send the dollar lower. As we have seen.

If the regulating capital is in the USA, then investment will move to the USA. That regulating capital is determined by the real profit rate, not the price of selling the good.

Profit rates are in competition with wages, so lower wages can impact who the regulating capital is, based purely by real wage rate differences between the countries. However, wage rates are not the only determinant of profits.

Indeed, Canada is cheaper than the USA on "hourly wages" in most industries.

The difference between Canada and the USA is the size of the subsidy regime more than total compensation. This difference is on the amount of wealth that is available to be transferred to capital from the public.

In the USA, the state functions as a giant machine that has provided the maximum amount of profit subsidy support available to private capital. This isn't a monopoly situation, but a situation of state support for aspects of private industry the drive profitability.

The take-home here is that under classical economic theory, it is not the support for a specific industry or specific part of an industry, it is the support for specific companies through general profit support for finance that is important.

Trump, even more than Biden, is focused on deciding winners in this respect. Specific investment supports for specific companies in essential industries. Not to make monopolies, but to ensure investment flows into the USA from other countries.

This is, of course, a very simplified model of this interaction, but it is illustrative of determining which policies will be beneficial to deal with capital flight. And, capital flight is what we are seeing when what was expected investment is delayed or abandoned from Canada.

That investment shift is what is moving the dollar values. Money flowing out of everywhere and into the USA.

The response in Canada can form a few pathways.

- Subsidize capital profits of certain companies above the rate that the USA is.

- Be satisfied with lower foreign investment production for traded goods.

- Find some "other" way to make investment in production.

- Find other places to trade that have more or less equivalent profit rates.

All four are likely necessary if Canadian production is going to be sustained. And, all three are being demanded from different parts of the political spectrum—depending on the interests driving those demands.

The response from the left needs to align to our interests and our (obviously more correct) reading of the economy.

That sits in the "other" way to make investment in production and finding other places to trade than the USA (with similar profit rates).

That "other" is looking back to what Canada used to do that worked in the earlier parts of the 1900s, which sounds a lot like state-owned enterprise written like "Crown Corporation" or "Public Utility" or any of the other myriad of ways that we have public production in Canada. The other places are literally any other country where their capital is not totally beholden to the Americans. This is not easy, but possible.

It is also not easy, but necessary given the threat faced.

Tariffs