Trade and price

One thing that will be interesting to watch during this tariff and investment war the USA has launched against the world is how it will affect prices.

Different economic ideologies have very different ways of understanding price setting.

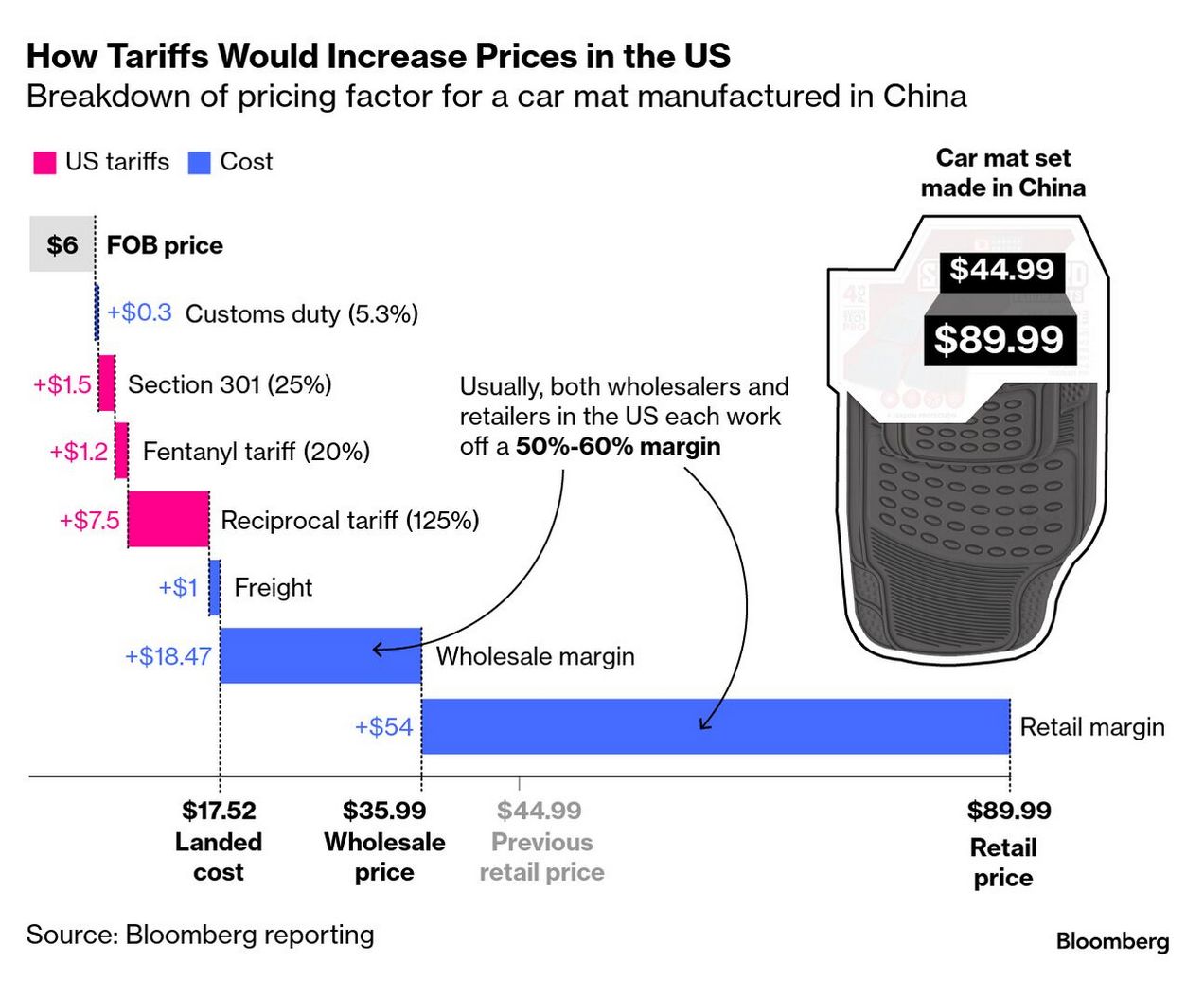

Neoclassical economists see taxes and tariffs on top of price. You can see it in the diagram that Bloomberg has posted on their website how they envision prices being affected by tariffs.

This is a strange view of price, but it is easy to see how economists like to think of the price/value of a good as simply the cost of making it at the lowest wage possible and that is the actual price of a good. Then you have all these other costs, as if you could sell something without these additional costs.

- Shipping the good is not in the "original" price

- Taxes are in addition to the price

- Tariffs are in addition to the price

- Profits are not in the price

- Wholesale margin is a single, unvarying price

- Retail margin is a single, unvarying price

- Variable wages are in the price

This assumes that production will always be at the lowest possible production costs. However, this version of price makes little sense if the goal is to force production to the USA to avoid tariffs because the impediment to production in the USA are the variable production costs.

In classical economics, the final price is the competitive price. It is only looking at the total input costs of a commodity and the final exchange value of that commodity that we can find the price. All the parts that make up those costs exist in a competitive environment where socially determined things like wages, subsidies, regulations, taxes, and tariffs and real competitive costs such as distance to market, material and fuel input prices paid, debt prices, discounting, existing productivity, costs of shifting investment, and profitability affect the final price of a good.

It is this final price that is competitive in the market or not and that is still a dynamic system in spite of tariffs, barriers to trade, or subsidy regimes.

Policy should be examining all these production costs for production to be competitive in local and export markets. It also matters what the profit rate does in the end at the firm level (not the individual good level). Firms can operate across product ranges and off-set low profitability in one good with higher profitability in another good—if it is advantageous to the firm.

And, all these go into calculations around private investment, determining where production goes which affects that price.

As we see the shifting investment programs and measuring how firms make these decisions and who is competitive will show real calculations made by investors and firms in response. All within a dynamic system, not a simple increase in price because of tariff increases.

The take-home from the classical point of view is that while investors are not happy right now with the volatility, they should not all be confused with capital writ large. Capital will seek out profit and make profit because Trump is not changing anything about the system.